SBA Hot Topic Tuesday — SBA Rescinds Non-Citizen 5% Ownership Rule

by Bob Coleman

Founder & Publisher

Effective March 1, 2026, this Notice rescinds SBA Procedural Notice 5000-872050, removing the narrow exception that allowed a Borrower to have up to 5% ownership held by foreign nationals, or U.S. Citizens, U.S. Nationals, or Legal Permanent Residents (LPRs) whose Principal Residents was outside of the United States, its territories, or possessions.

Effective March 1, 2026, this Notice rescinds SBA Procedural Notice 5000-872050, removing the narrow exception that allowed a Borrower to have up to 5% ownership held by foreign nationals, or U.S. Citizens, U.S. Nationals, or Legal Permanent Residents (LPRs) whose Principal Residents was outside of the United States, its territories, or possessions.

Further, and beginning with the Effective Date of this Notice, Legal Permanent Residents (LPRs) will not be eligible to own any percentage interest in an Applicant/Borrower, OC, or EPC.

Read the notice here.

Note, all SBA 7(a) and 504 notices are posted on our website and can be accessed with Coleman’s public Google spreadsheet.

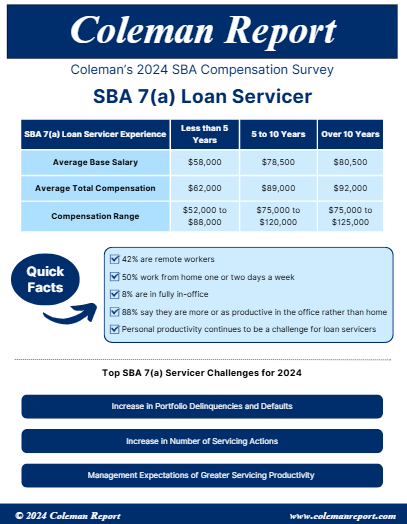

Coleman’s SBA Lender Compensation Survey Portal Open Until 2/10/26

Your SBA lending team is invited to participate in Coleman’s 33rd annual SBA department compensation survey. Although survey participants will remain anonymous, they may submit an email address to receive a complimentary copy of the report for their job description.

Your SBA lending team is invited to participate in Coleman’s 33rd annual SBA department compensation survey. Although survey participants will remain anonymous, they may submit an email address to receive a complimentary copy of the report for their job description.

Click on your department below to complete Coleman’s 2025 SBA lender department compensation survey. The survey will close on February 10, 2026.

- SBA Loan Department Manager Survey

- SBA Loan Sales Manager Survey

- SBA Business Development Officer Survey

- SBA 7(a) Loan Underwriter Survey

- SBA 7(a) Loan Packager Survey

- SBA 7(a) Loan Closer Survey

- SBA 7(a) Loan Servicer Survey

- SBA 7(a) Loan Liquidator Survey

Underwriting & Closing SBA Business Acquisition Loans — Webinar 2/4

In FY 2025, 23.6% of SBA 7(a) loan dollars (over $9 billion) were used for business acquisitions, confirming that change-of-ownership financing remains one of the most active and scrutinized segments of the SBA program. With Baby Boomers still owning approximately 40% of all U.S. small businesses, the volume of transition transactions continues to rise.

Led by Lance Sexton, former SBA Deputy Director of the Little Rock Servicing Center and current EVP of Phoenix Lender Services, this training provides a practical, compliance-focused guide to underwriting and closing SBA business acquisition loans.

New SOP 50 57 4: SBA Mandatory Deadlines and Expanded Guaranty Repair and Denial Guidance — 2/11

SBA lenders are facing a wave of new compliance challenges with SOP 50 57 4, effective November 1, 2025. The revisions reshape how lenders must service and liquidate SBA loans, and a missed step could put your guaranty at risk. From new deadlines to expanded denial grounds, the pressure is on compliance teams to update policies and procedures quickly. The rules of SOP 50 57 3 are no longer enough.

SBA lenders are facing a wave of new compliance challenges with SOP 50 57 4, effective November 1, 2025. The revisions reshape how lenders must service and liquidate SBA loans, and a missed step could put your guaranty at risk. From new deadlines to expanded denial grounds, the pressure is on compliance teams to update policies and procedures quickly. The rules of SOP 50 57 3 are no longer enough.

Attendees will walk away with practical strategies to protect their SBA guaranty, including updated compliance manuals, checklists, and training tools for staff. The result is peace of mind: you’ll know how to meet SBA’s new expectations, avoid costly mistakes, and strengthen your institution’s control over servicing and liquidation under SOP 50 57 4.

Learn more and register here

Underwriting SBA 7(a) Small Loans After SBSS: What Lenders Must Change by March 1, 2026 — 2/12

The SBA has changed the underwriting rules for 7(a) Small loans under $350,000. Effective March 1, 2026, the SBA is ending the use of the SBSS score for all 7(a) Small loans and returning to the requirement for documented repayment ability based on cash flow.

The SBA has changed the underwriting rules for 7(a) Small loans under $350,000. Effective March 1, 2026, the SBA is ending the use of the SBSS score for all 7(a) Small loans and returning to the requirement for documented repayment ability based on cash flow.

The training in this webinar shows how SBA expects underwriters to evaluate files, how to document repayment ability and where lenders can apply common sense judgments without creating SBA denial of guaranty risk.

Learn more and register here

Coleman Certified SBA 7(a) Loan Underwriting 2026 Training

The Coleman SBA 7(a) Certified Underwriter Training Program enters 2026 following a complete rebuild. The structure is redesigned. The curriculum is expanded. Production quality has been elevated. New instructors have been added. Every element is engineered to help SBA credit professionals master the intricate requirements of producing a defensible, banker-ready credit memo.

The Coleman SBA 7(a) Certified Underwriter Training Program enters 2026 following a complete rebuild. The structure is redesigned. The curriculum is expanded. Production quality has been elevated. New instructors have been added. Every element is engineered to help SBA credit professionals master the intricate requirements of producing a defensible, banker-ready credit memo.

The urgency for training has never been higher. SBA credit is entering a new regulatory era. Program guidance continues to shift. SBA has eliminated the “do what you do” rule. SBA, regulators, and credit committees now expect a higher standard of risk assessment and clearer, more disciplined explanations supporting credit approval.

Read more and enroll here

|

|

|

|

|

|

|

|

COLEMAN YOUTUBE

A Coleman Conversation: Sherri Seiber and Shay Kleinschmidt (1/28/26)

$55 Million Bank Loan Fraudster’s Fake Paper Trail Nets 6 Years in Prison (1/26/26)

Wichita Falls Banker Sentenced to 4 Years for $500K PPP & EIDL Loan Fraud (1/16/26)