According to PayNet small business insights, new loan volume was up at the start of 2023, but default rates and delinquency rates were also higher at the beginning of the year. Here are the facts from index readings in January 2023:

According to PayNet small business insights, new loan volume was up at the start of 2023, but default rates and delinquency rates were also higher at the beginning of the year. Here are the facts from index readings in January 2023:

|

|

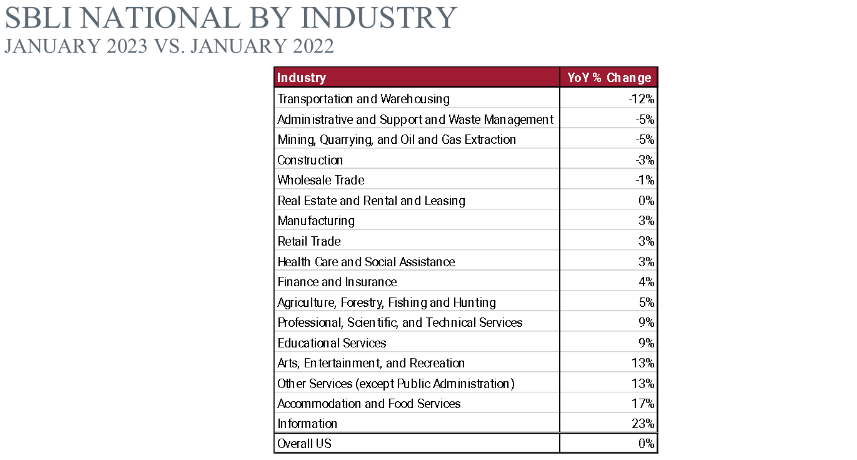

Small Business Lending Index • The Small Business Lending Index increased by 11% from December 2022 to January 2023. • In comparison to January 2022, the Small Business Lending Index in January 2023 is 5% higher. • The information industry saw the biggest increase from January 2022 to January 2023 with a 23% rise. • Accommodation and Food Services had the second greatest change with an increase of 17% compared to last year. • Transportation fell 12% in January 2023 when compared to the year before. |

|

|

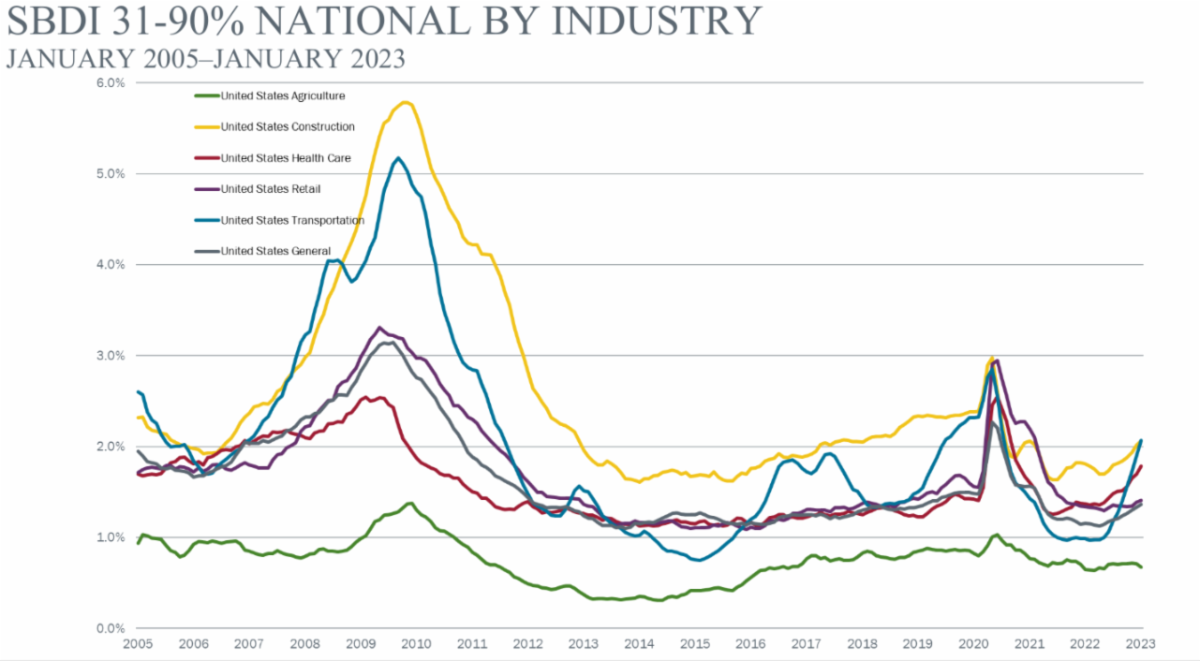

Small Business Delinquency Index • The Small Business Delinquency Index continued to increase for the ninth consecutive month in January, reaching 1.48%. • The delinquency rate for the agricultural industry decreased compared to one month ago. • Transportation saw the biggest increase compared to December 2022 followed by Health Care and Construction. • The transportation industry’s delinquency rate went up 110% from January 2022 to January 2023. |

|

|

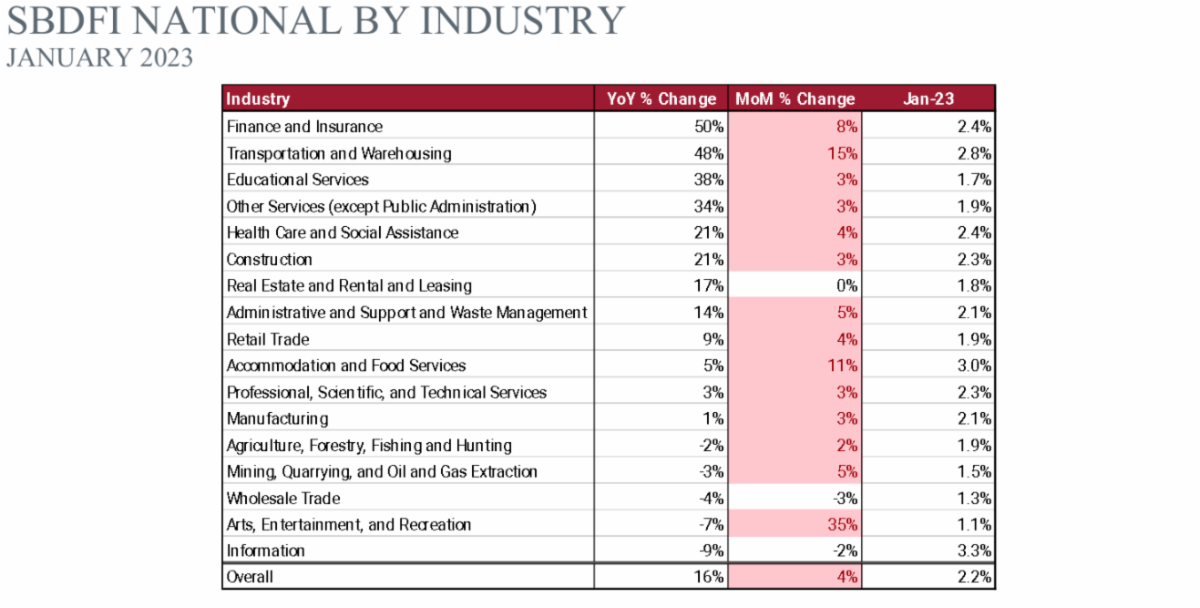

Small Business Default Index • The Small Business Default Index also saw a rise in the default rate for the eighth consecutive month. The reading in December 2022 was 2.07%, and in January 2023, it reached 2.16%. • While the information industry’s default rate dropped by 2% from December 2022 to January 2023, the industry had the greatest default rate at 3.3%. • With the second-highest default rate, 2.8%, the transportation industry’s rate increased by 15% from December to January. • Although Arts, Entertainment, and Recreation had the lowest default rate in January at 1.1%, they had the most substantial increase from December (up 35%). Source: |

# # #

About the U.S. Small Business Administration

The U.S. Small Business Administration makes the American dream of business ownership a reality. As the only go-to resource and voice for small businesses backed by the strength of the Federal Government, the SBA empowers entrepreneurs and small business owners with the resources and support they need to start, grow or expand their businesses, or recover from a declared disaster. It delivers services through an extensive network of SBA field offices and partnerships with public and private organizations. To learn more, visit www.sba.gov.