Livonia, MI – Citizens Research Council of Michigan today released a comprehensive analysis of a local sales tax policy for the City of Detroit. We found that the relatively small potential revenue, in the context of Detroit’s $1.6 billion budget, is offset by the steep challenges that would stand in the way of enacting a one-percent tax. City policymakers will need to assess whether the potential new revenues are worth the state and local efforts required to secure authorization for such a tax.

Michigan’s local governments rely primarily on property taxes to fund local government services, fire and police services, parks and recreation, libraries, and roads. This heavy reliance on property taxes, which are subject to multiple state-imposed growth limitations, affects the ability to raise the revenues needed to fund these services.

Detroit, with a weak property tax base, levies high property taxes and relies heavily on the income tax. The tax burden affects the city’s cost of living and the cost of doing business.

The benefits of a local sales tax include improving revenue diversity, capturing growth in local commerce, and reducing dependence on state revenue sharing. In destination cities such as Detroit, visitors’ contributions to local sales tax revenues could reduce residents’ overall tax burden.

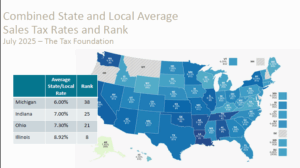

The paper affirms that a local sales tax option is a reasonable consideration for Michigan, as the state ranks 38th in combined state and local sales tax rates and is well below its neighbor states, Ohio, Indiana, and Illinois.

Currently, 37 states allow local governments to levy a sales tax; Alaska has only local sales taxes, and four states don’t levy state or local sales taxes. No local sales taxes are levied in Michigan.

Authorizing a local sales tax in Michigan will require amending the state Constitution, adopting state statutes authorizing local sales and use taxes, enacting an ordinance by the city council, and voter approval of a new tax.

“While the path to adopting a local sales tax option for Michigan’s local governments is daunting, access to taxes that diversify local revenue would improve the fiscal health of the state’s most populous cities and counties,” said Madhu Anderson, senior research associate for local affairs. “However, the research suggests that local sales taxes may be better suited to be levied at the county or regional levels to maximize potential revenue and minimize potential economic disruptions.”

Estimating the revenue potential of a one percent local sales and use tax in Detroit is challenging. Data on sales tax collections are not available by geographic location, do not accurately reflect state sales and use tax laws, and household spending and taxable purchases are not available for city visitors. The Research Council estimates that a one percent sales tax in Detroit would yield about $72 million annually.

The Research Council undertook the analysis at the request of the Detroit City Council’s Legislative Policy Division, which asked for a study of innovative ways to increase city revenues to support its growth as a destination city without placing an undue burden on its residents. The two-part study evaluated an amusement tax in a report released last year and this report on a local sales tax.