-1.png?width=300&name=thumbnail_image001%20(1)-1.png)

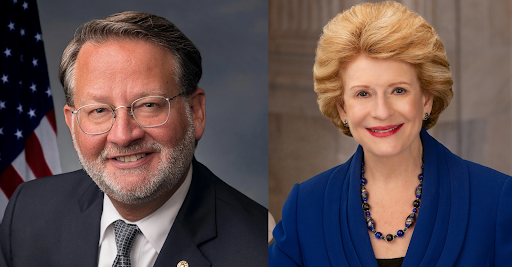

LANSING – Senator Stabenow, senior member of the Senate Finance Committee and leader on clean energy manufacturing policy, released the following statement on the U.S. Department of Treasury’s final rules for the 48D Advanced Manufacturing Investment Tax Credit. Stabenow authored this credit in the CHIPS and Science Act to support domestic solar and semiconductor manufacturing.

“When I authored this investment tax credit, I knew this would be important for Michigan manufacturers and workers. They are already leading America’s clean energy future and this will incentivize more jobs in Michigan. This is another exciting announcement from The CHIPS and Science Act that will continue to revitalize America’s semiconductor industry and strengthen our domestic solar supply chain.”

Authored by Senator Stabenow, the 48D Advanced Manufacturing Investment Tax Credit will provide a 25% tax credit and allow for a wide range of qualified investments necessary to create equipment for and manufacture semiconductors. The final rules announced by the Treasury Department will protect our national security, create good-paying jobs, and ensure the technologies of the future are made in America. This builds on the investments being made in Michigan from the CHIPS and Science Act, including up to $325 million in federal funding for Hemlock Semiconductor to build a new manufacturing facility to expand production of hyper-pure polysilicon needed to manufacture semiconductor chips.

# # #

.png)