Largest Fund in Cinnaire’s History Targets Support of 1,900 Affordable Homes

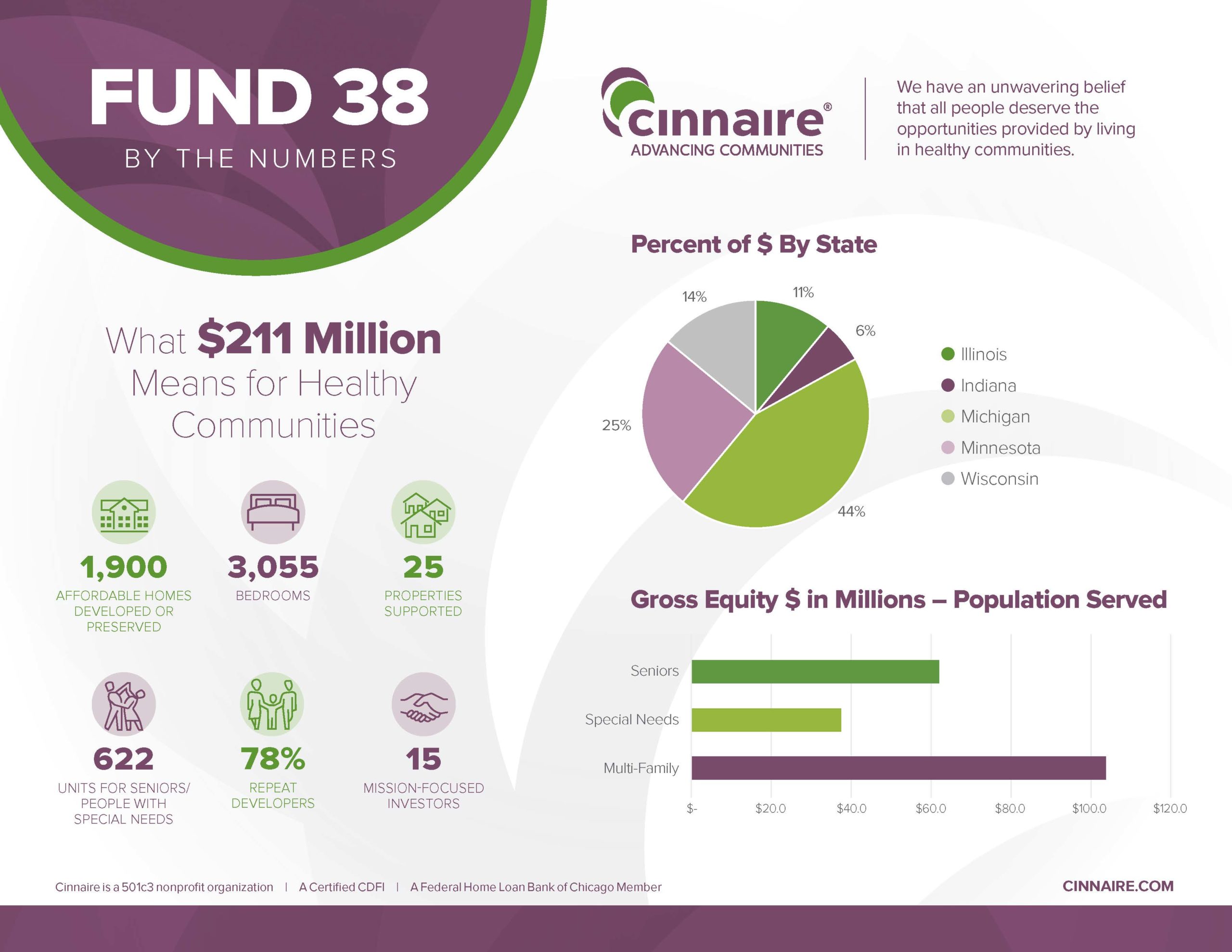

Cinnaire announced the closing of a $211 million Low-Income Housing Tax Credit (LIHTC) Equity Fund with capital raised from fifteen institutional investors. The fund is the largest single equity fund in Cinnaire’s 29-year history and will infuse capital investments into 25 affordable housing properties to create or preserve more than 1,900 homes in five states. Cinnaire’s 2022 Community Fund (Fund 38) raised equity from 12 repeat and three new investors.

“We recognize that safe, affordable housing has never been more meaningful, serving as a school, workplace, health center, and even church in recent years,” said Mark McDaniel, Cinnaire President, and CEO (left). “As the need for safe, affordable housing has grown, our team was inspired to reach higher and bring together developers and investors committed to increasing opportunities for affordable housing, the cornerstone of healthy communities.”

“We recognize that safe, affordable housing has never been more meaningful, serving as a school, workplace, health center, and even church in recent years,” said Mark McDaniel, Cinnaire President, and CEO (left). “As the need for safe, affordable housing has grown, our team was inspired to reach higher and bring together developers and investors committed to increasing opportunities for affordable housing, the cornerstone of healthy communities.”

The Fund will support 25 multi-family developments in Michigan, Indiana, Wisconsin, Illinois, and Minnesota. These developments include Terrace Heights in Wausau, WI, the revitalization of an aging affordable housing community that will provide 4 two-bedroom and 10 three-bedroom units for families in a largely Hmong community serving residents natively from Laos, Thailand and South China, and Restoring Waters in St. Paul, MN, a 60-unit supportive housing community providing affordable housing with support services for women and families recovering from trauma. Overall, the fund will create 1,900 units equating to 3,055 bedrooms serving more than 3,800 individuals including 662 units for seniors or individuals and families with special needs.

“As demand for affordable housing continues to skyrocket, our team has leaned into our commitment to building strong, equitable communities by delivering financing options to increase high-quality, affordable housing across our footprint,” said Brett Oumedian, Cinnaire Chief Financial Officer.

“We are inspired and grateful for the tenacity of our developer and investor partners who have demonstrated their commitment to expansive local prosperity, the human spirit, individual potential, and well-built communities through their record-setting participation in this fund,” said Susan Frank, Cinnaire Executive VP, Business Development. “This fund will increase financial stability for families while creating jobs and boosting the local economy.”

The fund brings Cinnaire’s total equity investment raised since inception to more than $5 billion.

About Cinnaire

Cinnaire is a non-profit financial partner that supports community and economic revitalization initiatives through creative investments, loans, and development services. Since 1993, Cinnaire has invested $4.7 billion to develop 811 housing communities in 10 states, providing 49,700 affordable apartment homes for more than 100,000 individuals and families, and has provided community development loans to support the creation/retention of more than 187,000 square feet of commercial, mixed-use, and community space. In its mission to change lives and transform neighborhoods into thriving communities, Cinnaire has helped to create or retain over 76,000 jobs and spurt $7.9 billion in economic impact. www.cinnaire.com